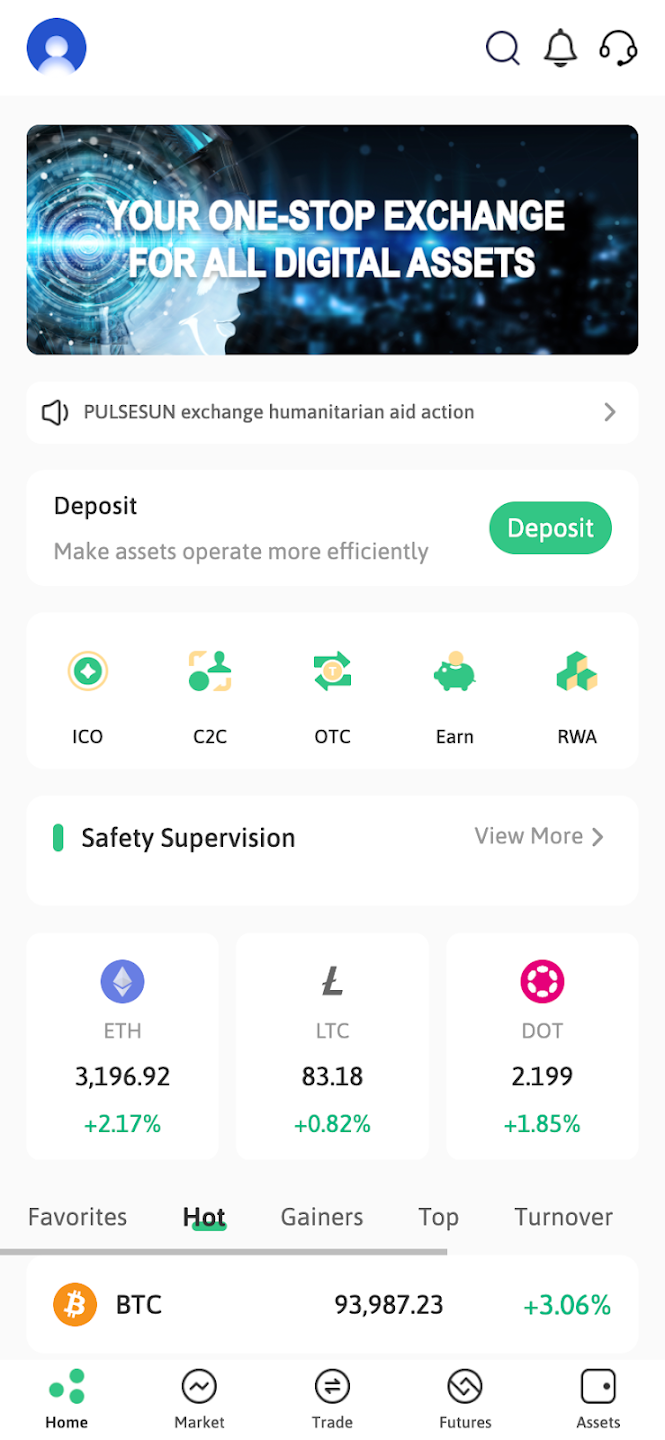

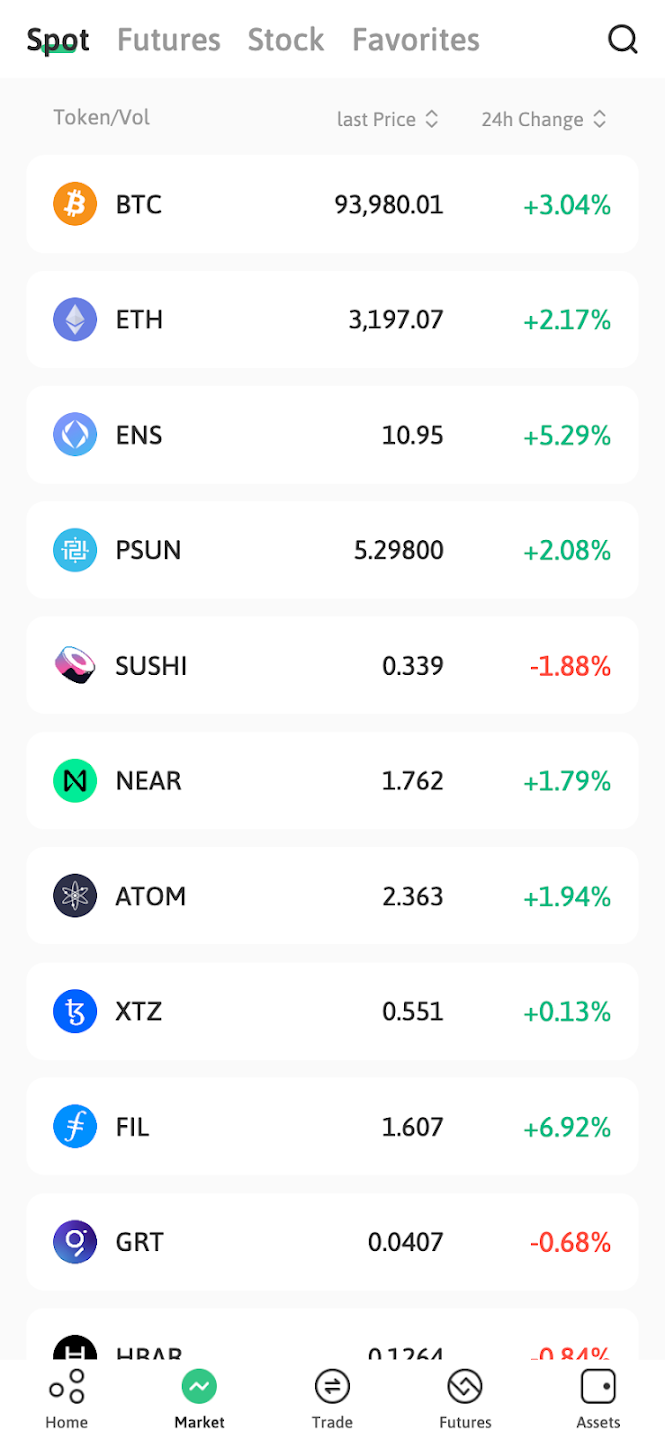

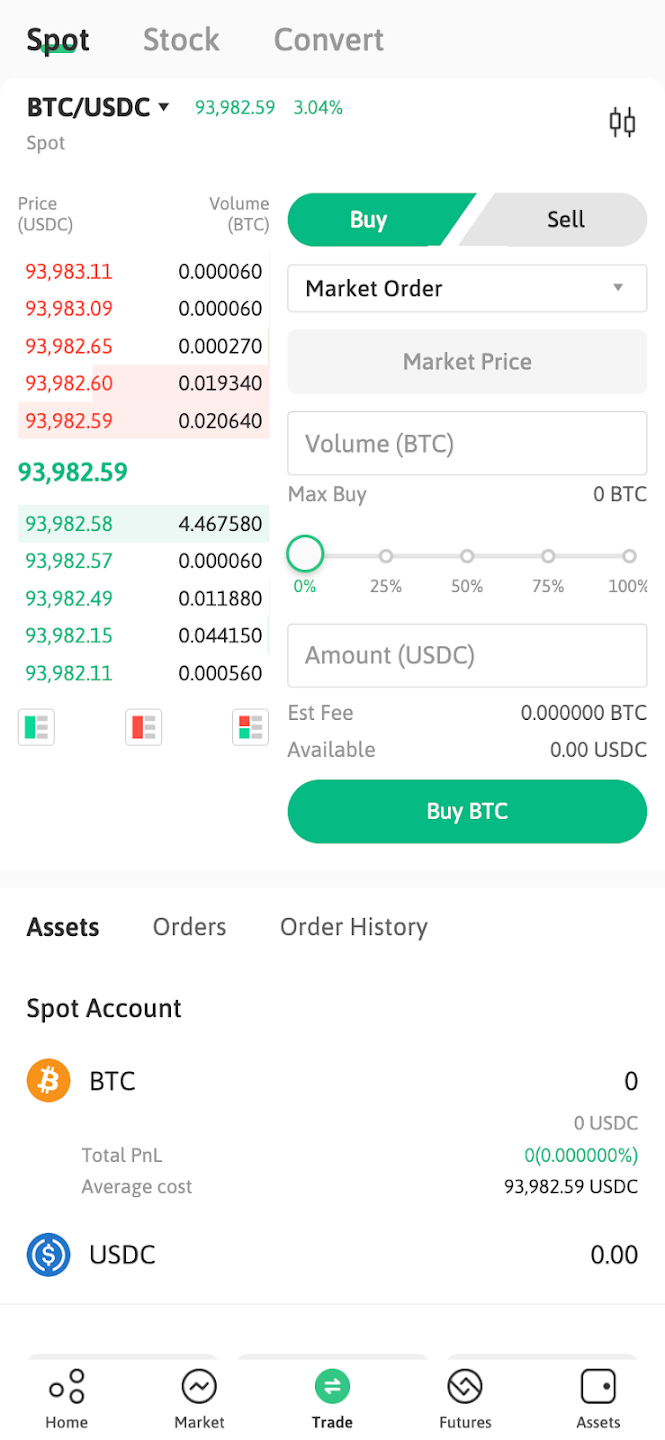

Screenshots

Basic Information

Profile & Analysis

Pulsesun Crypto is an education-first crypto strategy app built under the PULSESUN Trading Center ecosystem. Instead of enabling real-money trading, it provides simulated market data, a structured strategy journal, replayable K-line sessions, and pattern filters designed for learning, practice, and disciplined review.

Company Background

The product is presented as a “clean, compliant crypto strategy studio built for learning,” aiming to make crypto trading education more accessible without exposing users to financial loss. The platform highlights a training workflow that emphasizes hypothesis creation, replay-based practice, and iterative refinement, which aligns with an educational rather than speculative positioning.

Services

- Strategy Journal for recording bias, timeframe, thesis, and key levels

- Replay Practice for reviewing candle history and training price-action reading

- Pattern Scanner for filtering momentum, reversal, and range-style setups

- Focus Pairs to maintain a short study list of selected symbols

- Local Storage for keeping entries on-device for privacy and offline access

- Educational workflow built around repetition, review, and structured learning

Is Scam?

Pulsesun Crypto does not resemble typical scam patterns found in high-risk crypto products. Its core functions focus on simulated learning rather than requesting user deposits or promising returns. The app’s descriptions emphasize education, practice, and documentation, which reduces the likelihood of misleading financial claims being central to the product experience.

A key difference is that the learning module is framed around risk-free training: users can replay market scenarios, document hypotheses, and study patterns without executing real trades. This transparent positioning, paired with privacy-oriented local storage for entries, supports a more conservative and credibility-focused product model.

Conclusion:

Pulsesun Crypto is positioned as a legitimate educational application focused on simulated crypto strategy practice. Based on its stated design—simulation-first training, journaling, replay study, and privacy-oriented storage—the product shows a clear learning orientation rather than the behaviors commonly associated with scam or deposit-driven platforms.

FAQ

Does Pulsesun Crypto support real trading with deposits?

No. The product description emphasizes simulated market data and learning workflows rather than deposit-based real trading.

What is the main purpose of the Strategy Journal?

It helps users document a hypothesis (bias, timeframe, thesis, and key levels) so learning can be reviewed and improved over time.

How does Replay Practice help users learn price action?

Replay allows users to scrub through historical candle data, practice reading market structure, and repeat scenarios without financial exposure.